Navigating Roof Replacement and Insurance Claims

Your home has just been damaged by severe weather. In most cases, this will likely mean navigating not just a roof replacement but also an insurance claim. If you are in this situation and feeling a little overwhelmed, you are not alone. Because most Colorado residents will experience a severe weather event in their lifetime, understanding this process is important whether you’re a homeowner, a business owner, or a property manager. Unfortunately, identifying roof damage, documenting it, and navigating your insurance claim is often difficult. With decades of experience in the industry and a team of insurance specialists, we plan to simplify the insurance-backed roof replacement process. Having an understanding of this process is essential for making informed decisions.

Roof replacement alone, an essential aspect of property maintenance, can be an intimidating task. This becomes even more of an issue when combined with the hassles of an insurance claim. Homeowners need to know their insurance policy specifics, the extent of damage, and the world of roofing materials and labor costs. Navigating this process is much less stressful with understanding insurance terminology, documentation requirements, and inspection procedures. This can easily overwhelm even the most seasoned property owner.

Why is it important to understand this process? In short, it empowers you. Knowledge of insurance-covered roof replacements lets you communicate effectively with insurance adjusters and roofing contractors. It also allows for a better understanding of policy specifics. It also ensures you’re aware of unexpected costs and discrepancies in coverage. This makes the process smoother, and the property owner feels more confident in their decisions. So, let’s gain knowledge that empowers you to protect your property and investment with knowledge and clarity.

How Insurance Timelines Shape Your Roof Replacement

What is considered a "Timely Manner"?

When it comes to protecting your property, time is of the essence. Insurance providers operate under the principle that prompt action leads to protection. Homeowners should make a practice of reporting damage within specific timelines. This will ensure your insurance coverage remains intact. It is a best practice to inspect for damage after any severe weather event.

Most insurance companies operate on a timeline that allows a year as the window for reporting damage from your date of loss. This timeline plays an important role in determining your coverage. If you surpass this one-year mark, the likelihood of your insurance company covering the damages declines considerably. At this point, the door to coverage starts to close. This highlights the importance of acting quickly.

Why insurance companies care when you file your roof replacement claim

There are several reasons why insurance companies impose this requirement, including:

-

Mitigating Further Damage:

Reporting damage as soon as possible can help mitigate further damage to the property. For example, reporting a leaky roof promptly can prevent water damage from spreading to other areas of your home.

-

Protecting the insurance companies interests

Insurance companies have an interest in minimizing their losses and expenses, and reporting damage promptly can help them do so. By knowing about damage early on, the insurance company can investigate and assess it before it worsens.

Unveiling three vital steps for significant impact

When it comes to insurance-covered roof replacements, a lot of planning and strategic actions can make all the difference in securing complete coverage. This section discusses the three steps required for a successful insurance-covered roof replacement based on our experience. Each of these steps, though seemingly small, has the potential to impact your project’s outcome significantly.

Step 1: Document the Damage

Before starting any roofing project, documenting the extent of the damage is the first step. Armed with your smartphone or camera, either you or your roofing contractor should photograph the affected areas from multiple angles. Visual documentation is a powerful tool for showing the actual damage to both your insurance company and potential roofing contractors. These images are clear evidence of the state of your roof prior to repairs, strengthening your position in the claims process.

Step 2: Contact your insurance provider

Once you’ve documented the damage, your next move is to get in touch with your insurance provider promptly. Initiate the claims process by submitting the information you’ve gathered. Provide a detailed account of the damage, accompanied by the images you’ve captured. Your proactive approach to reporting the damage can accelerate the claims process and create a smoother experience.

Step 3: Choose a reputable roofer

Selecting the right roofing professional can significantly impact the quality of your replacement project. Look for a reputable roofer with a track record of excellence and integrity. A skilled roofing contractor will not only provide an accurate idea of the condition of your roof, but will also provide a clear and concise estimate. They should also be able to negotiate effectively with your insurance company. Their expertise ensures that the repairs align with industry standards and codes and your insurance coverage, minimizing the potential for discrepancies.

By following these three steps—documenting damage, contacting your insurance provider, and selecting a reputable roofer—you’re setting yourself up for a successful insurance-covered roof replacement. Remember, it’s the thoughtful attention to detail and strategic actions that pave the way for a seamlessly executed project that maximizes both your coverage and peace of mind.

your key to Preventing future property damage

It’s a fact that your roof and its components protect your home. When you see small problems with it, those are signals you should pay attention to. If you take action when you see these signals, you can often stop bigger issues from happening. But if you ignore these signals, even if they seem small, it can lead to more serious problems.

Issues that may arise when roof repairs are left unchecked

- damage from water leaks

- pest invasion

- Loss of energy efficiency

- additional damage

Taking care of roof damage immediately is crucial for your home’s safety, comfort, and how long it lasts. Even minor issues can become big headaches if you don’t fix them. For instance, a tiny leak can become a huge water problem that harms your home’s structure and causes mold, which can be expensive to fix.

The longer you wait, the more you’ll probably have to pay. Remember that your insurance company has a deadline for reporting damages if you want to get your roof repaired or replaced through your insurance. So, acting quickly saves you money and keeps things smooth with your insurance.

Issues that may arise when roof repairs are left unchecked

Fixing roof problems isn’t just about making things better now. It’s also about ensuring your property stays good in the long run. When you fix minor issues, you prevent more significant problems from showing up. So, even if it’s just a tiny crack or a leak, repairing it early can help your property stay strong and not have problems later.

In the end, paying attention to roof problems is like getting a heads-up. It’s a way to ensure your property stays in good shape and has no unexpected troubles. So, let’s learn more about how to take care of our properties and keep them safe for the future.

replacement cost value = Actual Cash Value + Depreciation

1. actual cash value

Actual cash value, or ACV, is a method insurance companies use to determine the value of an item damaged or lost in an insurance claim.

The actual cash value of an item is determined by considering its original purchase price, age, condition at the time of the loss or damage, and the current market value of similar items. Depreciation is taken into account because most items lose value over time due to wear and tear, obsolescence, or other factors.

It is important to note that insuring your property for its ACV only may result in a lower insurance premium, but it also means that you may receive less money in the event of a claim. With an ACV policy, you will be responsible for the difference between the determined actual cash value of your damage and the cost to restore it to pre-damage conditions.

2. depreciation

Depreciation is the reduction in the value of an item over time due to factors such as wear and tear, obsolescence, and aging. It is an essential concept in insurance because it affects the amount of money you can receive from an insurance claim.

When an item is insured, the insurance company may consider depreciation when determining value. Depreciation can be calculated in different ways depending on the type of item being insured.

It’s essential to understand how depreciation works when purchasing insurance and filing a claim, as it can affect the amount of money you receive from the insurance company. If you have any questions about how depreciation is calculated, you should talk to your insurance agent or read your insurance policy carefully to understand the terms and conditions.

2. replacement cost value

Replacement cost value, or RCV, is the amount of money it would take to replace an item with a new one of similar quality and functionality. It determines the maximum amount of money you can receive from an insurance claim.

When you purchase insurance, you may be asked to choose between insuring your property for its replacement cost or its actual cash value. If you choose to insure your property for its replacement cost, the insurance company will pay you the total cost of replacing the item with a new one, regardless of age or depreciation.

It’s important to note that insuring your property for its replacement cost may result in a higher insurance premium, but it also means that you can receive more money in the event of a claim. Reviewing your policy carefully is essential to understand any limits or exclusions.

roof replacement insurance payment timeline

In this section, we discuss key terms that play a vital role in understanding your coverage: deductibles, Actual Cash Value (ACV) payment, and Replacement Cost Value (RCV) payment. Whether you’re a homeowner or a business owner, these terms hold the key to making informed decisions when it comes to your roof replacement project.

Your Deductible

Think of a deductible as your initial contribution towards a covered insurance claim. It’s the amount you agree to pay out of your own pocket before your insurance company steps in. When it comes to roof replacements, your deductible is subtracted from the total cost of the repairs or replacement. Choosing a deductible that suits your financial situation is important, as it affects your insurance premium and the amount you’ll need to cover before your insurance kicks in.

ACV Payment

Actual Cash Value (ACV) is how insurance companies calculate the value of what you’re claiming for. They consider factors like the original purchase price, the item’s age, its condition at damage time, and current market values. ACV takes into account depreciation. This means items lose value over time due to wear and tear or other factors. If you have an ACV policy for your roof replacement, keep in mind that you might receive less money in case of damage, as you’ll be compensated for the current value of your roof, factoring in depreciation. When you receive and ACV check, it will be for the depreciated value of your damages. If you have an RCV policy, you will later receive the final payment after repairs are completed.

RCV Payment

Replacement Cost Value (RCV) payment provides a more comprehensive coverage option. With RCV, your insurance company covers the cost of replacing your damaged roof with a new one of a similar kind and quality without considering depreciation. This means you’re more likely to receive a higher payout that can better match the cost of restoring your property to its pre-damage state. While RCV insurance might come with higher premiums, it can be a reassuring choice for those seeking more complete coverage.

If you have an RCV policy, once all the repairs are complete, you will receive a final check. This will be for the remaining amount held back when the roof was depreciated. Once repairs are complete, you should be reimbursed for all costs except your deductible.

In conclusion, as you embark on your insurance-covered roof replacement journey, remember that understanding deductibles, ACV, and RCV payments is vital. By grasping these concepts, you’re equipping yourself to confidently navigate the claims process and ensure that your property’s protection aligns with your needs and financial situation. Feel empowered to make decisions safeguarding your investment while keeping you prepared for any unexpected twists.

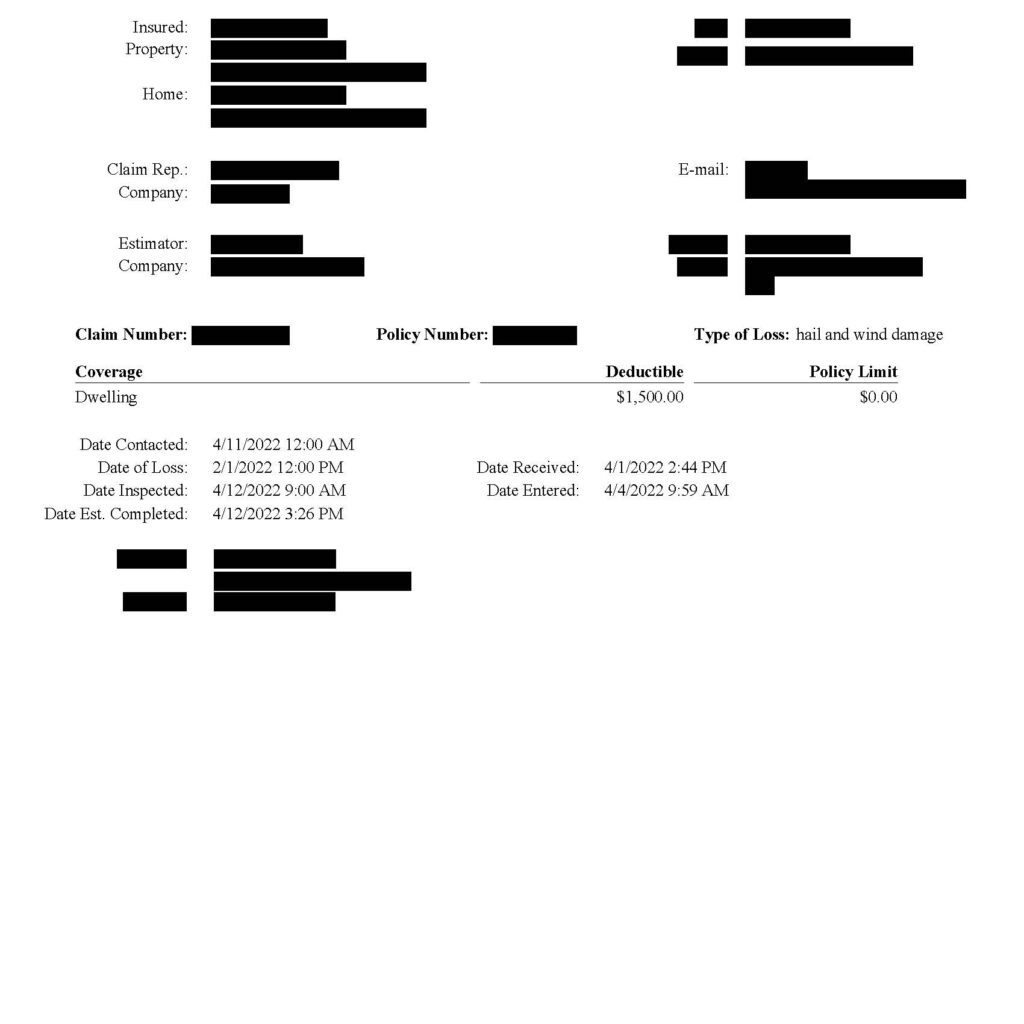

The front page of your insurance claim,

where everything you need to know is

The front page of your insurance policy contains critical information that you should review and keep handy in case you need to file a claim. This information includes your policy and claim numbers, when the damage was sustained, and all the necessary details for your insurance adjuster.

When you file a claim, your insurance company will use the information on the front page of your policy to process your claim quickly and efficiently. Your policy number and claim number are unique identifiers that help your insurance company access your policy and claim information promptly.

In addition to your policy and claim numbers, the front page of your policy should also include the date of loss, which is the date when the damage occurred. This information is critical because it helps insurance companies understand the timeline of events leading to your claim.

The front page of your policy should also include information about your adjuster, such as their name, contact information, and the inspection date. This helps you stay informed on your claim and lets you contact your adjuster if you have any questions or concerns.

In summary, the information on the front page of your insurance summary is critical in a claim. By reviewing and keeping this information handy, you can help ensure that your claim is processed quickly and efficiently and that you receive the compensation you are entitled to.

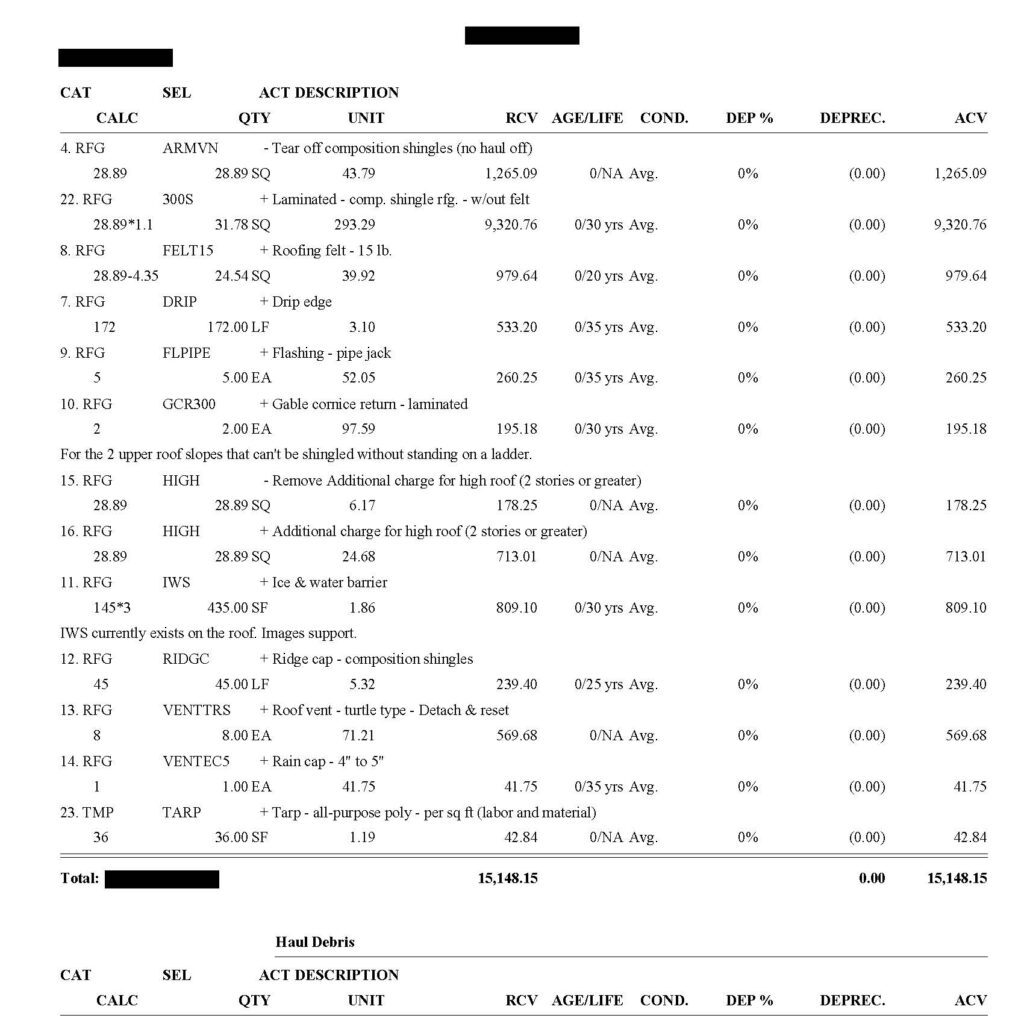

The repair pages,

where you talk numbers

The page or pages of a roof replacement estimate that discusses the amounts and what will be replaced are typically called the scope of work or the line item estimate. This page will list all of the individual items that will be replaced or repaired during the roof replacement, along with the cost for each item.

The scope of work will typically include a detailed breakdown of all the materials that will be used in the replacement, such as shingles, underlayment, flashing, and other necessary components. Each material will be listed with the corresponding quantity and cost so you can see exactly what is being used and how much it will cost.

In addition to the materials, the scope of work will include the cost of labor and any additional services, such as debris removal and disposal. Each service will be listed with the corresponding price, showing how much labor and services will cost.

It’s important to review the scope of work carefully to ensure that all of the necessary repairs and replacements are included and that the costs are reasonable and in line with industry standards. If you have any questions or concerns about the scope of work, it’s always a good idea to discuss them with your contractor or insurance adjuster to ensure that fully understand the estimate and what you will be paying for.

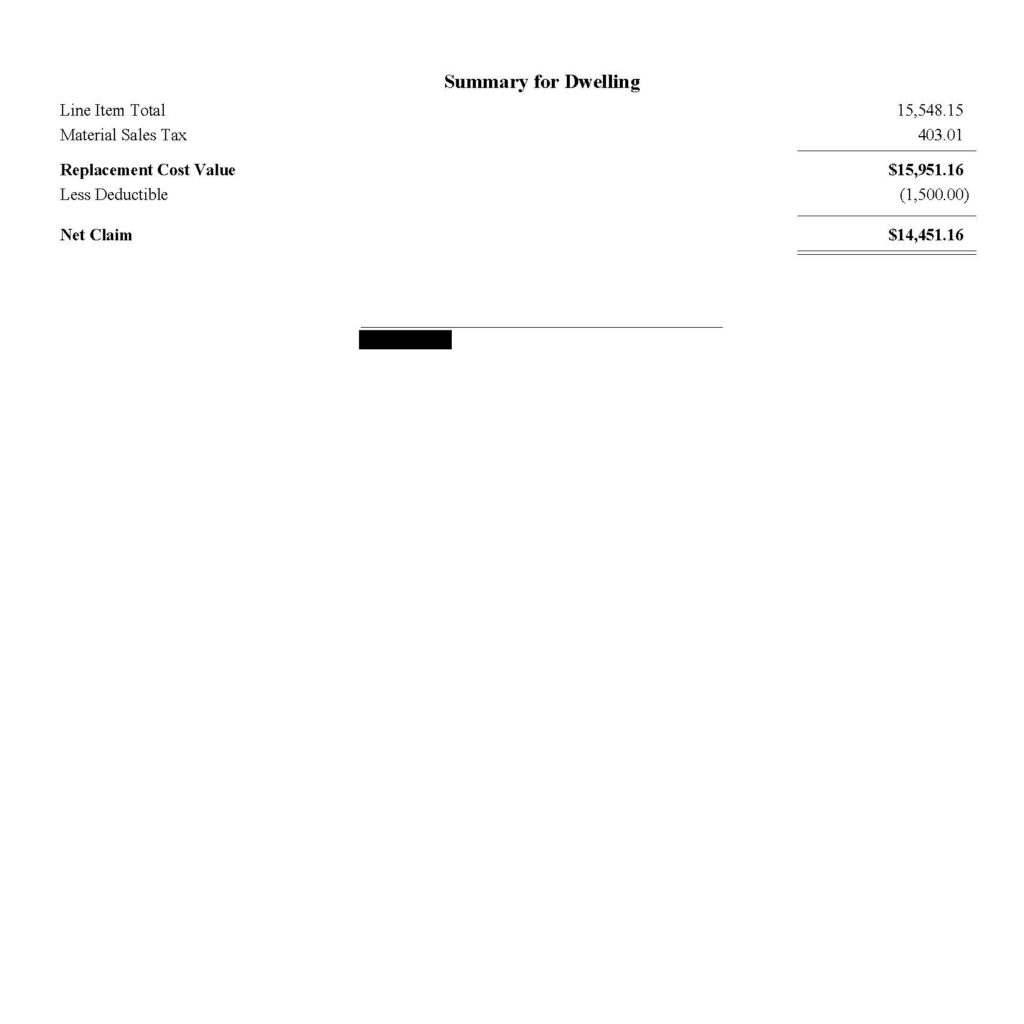

where your deductible comes into the equation

In this estimate, depreciation was not taken. However, you can see the line item for the depreciation deduction if it were to be taken. Your deductible and how it affects this process should have been noted on the repair page.

Every insurance policy has a deductible. Your deductible is a predetermined amount of money a property owner is responsible for if they file an insurance claim. Your insurance company covers any expense over that deductible amount.

When payment is made on your insurance claim, it will work like this. Your initial ACV payment will be made “less the deductible.” Once the ACV is determined, payment is made in the total ACV amount minus your deductible (typically from $500 to $2500), as that is the portion of the claim you are responsible for.

Often, this is where the claim could be more straightforward for property owners. When they see the term “less deductible,” they think their deductible has already been accounted for. That is not correct. The deductible is part of the estimate as a whole. So, your ACV + your deductible check + depreciation check = replacement cost value. The insurance company owes everything above and beyond the deductible amount. So, the property owner pays $500 or $1000 (or whatever their deductible is), and the insurance company covers all repair costs above that amount.

Example 1:

A rcv policy with a $1000 deductible

Most homeowners have RCV policies where their insurance company will pay for the total of repairs minus their deductible.

Let’s say a homeowner suffered roof damage during a hail storm. They have a $1000 deductible. Their asphalt shingle roof had standard architectural shingles, which have an average lifespan of 30 years; however, they were ten years old. Upon inspection, the roof needs to be replaced, and the cost to replace the roof will be $15,000.

Since the roof is ten years old, approximately one-third of its useful life has passed. In this case, the roof would be depreciated by 33% or $5000. This means that the current actual cash value or ACV is $10,000. When this is paid to the property owner, they will receive the ACV payment in full less the deductible. So, when the ACV check is issued to the homeowner, it will be $9000, with the customer contributing their $1000 deductible. The ACV check + the homeowners deductible = the total ACV amount.

This leaves $5000 of the remaining replacement cost value or RCV remaining. Once the repairs are complete, the depreciation check will be released in the total repair amount.

The ACV check from the insurance company (less the homeowner’s deductible amount) + homeowners deductible + depreciation check = replacement cost value (total claim amount).

In this example, the homeowner would have received a $9000 ACV check (the total ACV amount – the deductible) and a depreciation check for $5000. To restore this roof to pre-storm conditions, this homeowner is out-of-pocket $1000.

Example 2:

AN Acv policy with a $1000 deductible

Occasionally, property owners have an ACV policy only. Sometimes, this is in an attempt to save money, but sometimes it comes from needing a clearer understanding of what an ACV policy means.

The same homeowner suffered roof damage during a hail storm, but they have an ACV policy this time. They have a $1000 deductible. They have a standard architectural shingle roof with an average lifespan of 30 years. However, they were ten years old. Upon inspection, the roof needs to be replaced, and the cost to replace the roof will be $15,000.

Since the roof is ten years old, approximately one-third of its useful life has passed. In this case, the roof would be depreciated by 33% or $5000. This means that the current actual cash value or ACV is $10,000. When this is paid to the property owner, they will receive the ACV payment in full minus the deductible. So, when the ACV check is issued to the homeowner, it will be $9000, with the customer contributing their $1000 deductible. The ACV check + the homeowners deductible = the total ACV amount.

This is where things start to change. It still leaves $5000 of the replacement cost value or RCV. However, because this homeowner has an ACV policy only, They will not receive any additional insurance payments.

In this case, the homeowner would receive a $9000 ACV check ($10,000 ACV amount – deductible), and the remaining costs would be due from the homeowner. In this case, the property owner would be out-of-pocket $6000 to restore their roof to pre-storm conditions.

Contact Us Today

We Service and Support the Following Brands

Contact

Custom Exteriors, LLC

18674 Co Rd 3, Berthoud, CO 80513

109 E. 17th St. Ste 5822, Cheyenne, WY 82001

102 S. Tejon St. Ste 1100, Colorado Springs, CO 80903

404 Broadway, Eagle CO 81631

Phone: 970-460-8714

Toll Free: 800-580-0131

Quick Links

© 2022 Custom Exteriors, LLC